Weighted Average of Outstanding Shares Definition and Calculation

Given continuously changing stock prices, the investor will calculate a weighted average of the share price paid for the shares. To calculate the weighted average cost per share, the investor can multiply the number of shares acquired at each price by that price, add those values, and then divide the total value by the total number of shares. Shares outstanding are the stock that is held by a company’s shareholders on the open market.

What is a weighted average?

Shares outstanding refers to the amount of stock held by shareholders, including restrictive shares held by company insiders. A company, however, may have authorized more shares than the number of outstanding but has not yet issued them. These may later appear in the form of a secondary offering, through converting convertible securities, or issued as part of employee compensation such as stock options. Due to these factors, the actual number of shares outstanding can vary over the course of a reporting period.

- The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) in order to provide a fair view of a company’s financial condition.

- It excludes closely held shares, which are stock shares held by company insiders or controlling investors.

- The weighted average of outstanding shares is a calculation that incorporates any changes in the amount of outstanding shares over a reporting period.

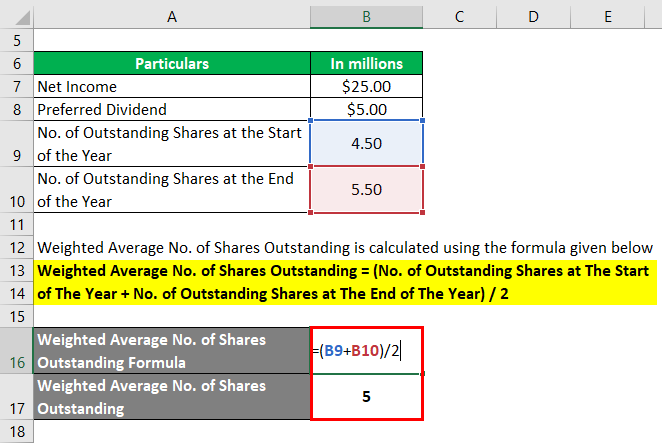

Using Excel to Calculate a Weighted Average

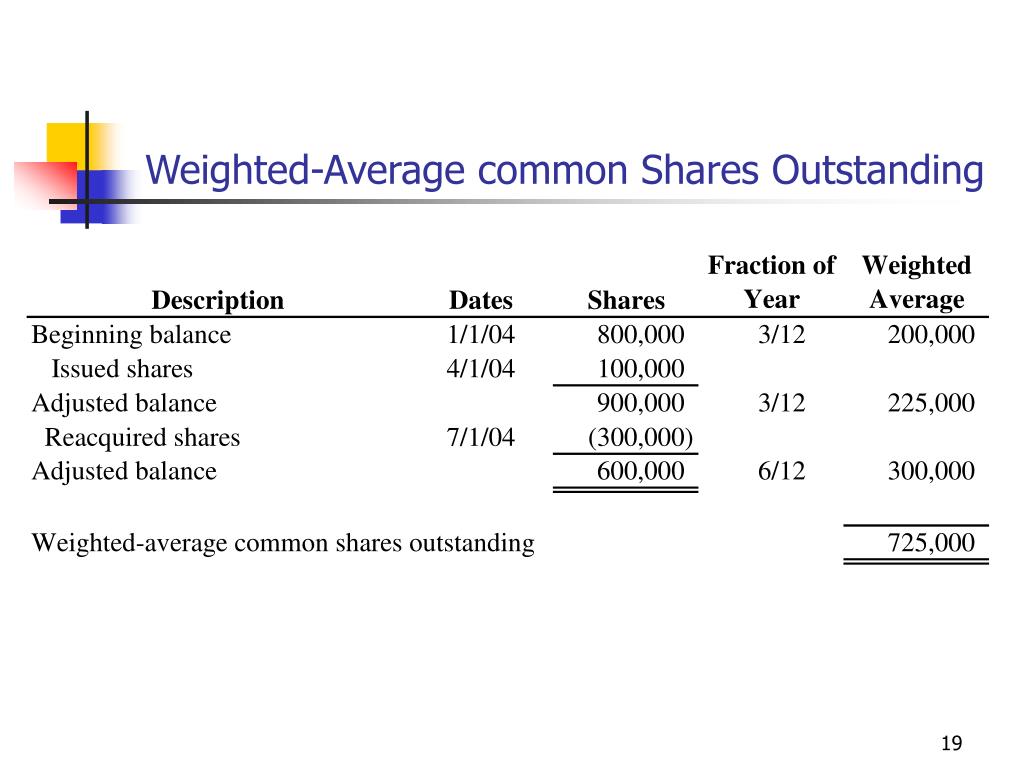

With this weighted average, we can now calculate a different and more accurate EPS of $0.80 per share. A weighted average is a way of taking the average of several numbers when a different “weight” is assigned to each one. sum of years A common example of a weighted average is calculating a grade point average for courses with different numbers of credit hours. Suppose that Company XYZ Corporation has 500,000 shares at the beginning of its fiscal year.

How Do Stock Buybacks Influence Shares Outstanding?

In September, half of these shares were repurchased by the company, reducing the number of outstanding shares to 75,000. While outstanding shares are a determinant of a stock’s liquidity, the latter is largely dependent on its share float. A company may have 100 million shares outstanding, but if 95 million of these shares are held by insiders and institutions, the float of only five million may constrain the stock’s liquidity.

Weighted Average Number of Shares

WASO’s primary application is in calculating EPS, a key indicator of a company’s profitability on a per-share basis. It’s crucial for investors who utilize EPS to compare companies’ financial health. An increasing WASO might dilute EPS, potentially affecting investor perceptions and company valuations. In calculating WASO, the period each share batch has been outstanding within a reporting period is accounted for, giving a temporally adjusted average that more accurately reflects the company’s share structure.

Example – impact of stock split

However, the value of each individual share is inversely related to the number of shares outstanding. This relationship makes understanding the dynamics of shares outstanding crucial for investors and industry analysts. In this case, the same result could have been achieved by multiplying the 111,000 shares from Example 1 by a factor of 2.

Weighted average shares is the number of all common stock that is in affect for a specific time frame, whereas basic shares are companies issued amount of common stock with actual stock certificates that have been issued. For example, let’s say a company has 100,000 shares outstanding at the start of the year. Halfway through the year, it issues new shares in the amount of an additional 100,000 shares.

Stock prices change daily and keeping track of the cost basis of shares accumulated over many years is desirable. A company may issue new shares to investors or buy its own shares from them during a period. Every time a company issues or repurchases shares, the total number of its outstanding shares changes.

Weighted averages may also be used in other aspects of finance including calculating portfolio returns, inventory accounting, and valuation. These actions can signal different strategic moves, such as a company’s confidence in its stock or efforts to consolidate ownership. By doing so, WASO offers a more accurate reflection of the company’s equity structure over time, crucial for financial analyses like Earnings Per Share (EPS) calculations. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Thus, the situation during the year was equivalent to having 111,000 shares outstanding throughout the year.

Calculating a weighted average of outstanding shares is important because it allows a company to calculate its earnings per share (EPS), which is a measurement of how much money a company makes for each share of its stock. Potential investors in a company look at the EPS as an indicator of the company’s profitability and compare this metric with the EPS of other companies before making an investment decision. In the above example, if the reporting periods were each half of a year, the resulting weighted average of outstanding shares would be equal to 150,000. Thus, in revisiting the EPS calculation, $200,000 divided by the 150,000 weighted average of outstanding shares would equal $1.33 in earnings per share. A company’s outstanding shares may change over time because of several reasons.