Diluted Shares Financial Edge

Options allow holders to buy the share at a specific price and during a certain period. To understand how diluted EPS works, let’s look at the formula of diluted earnings per share. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Ask Any Financial Question

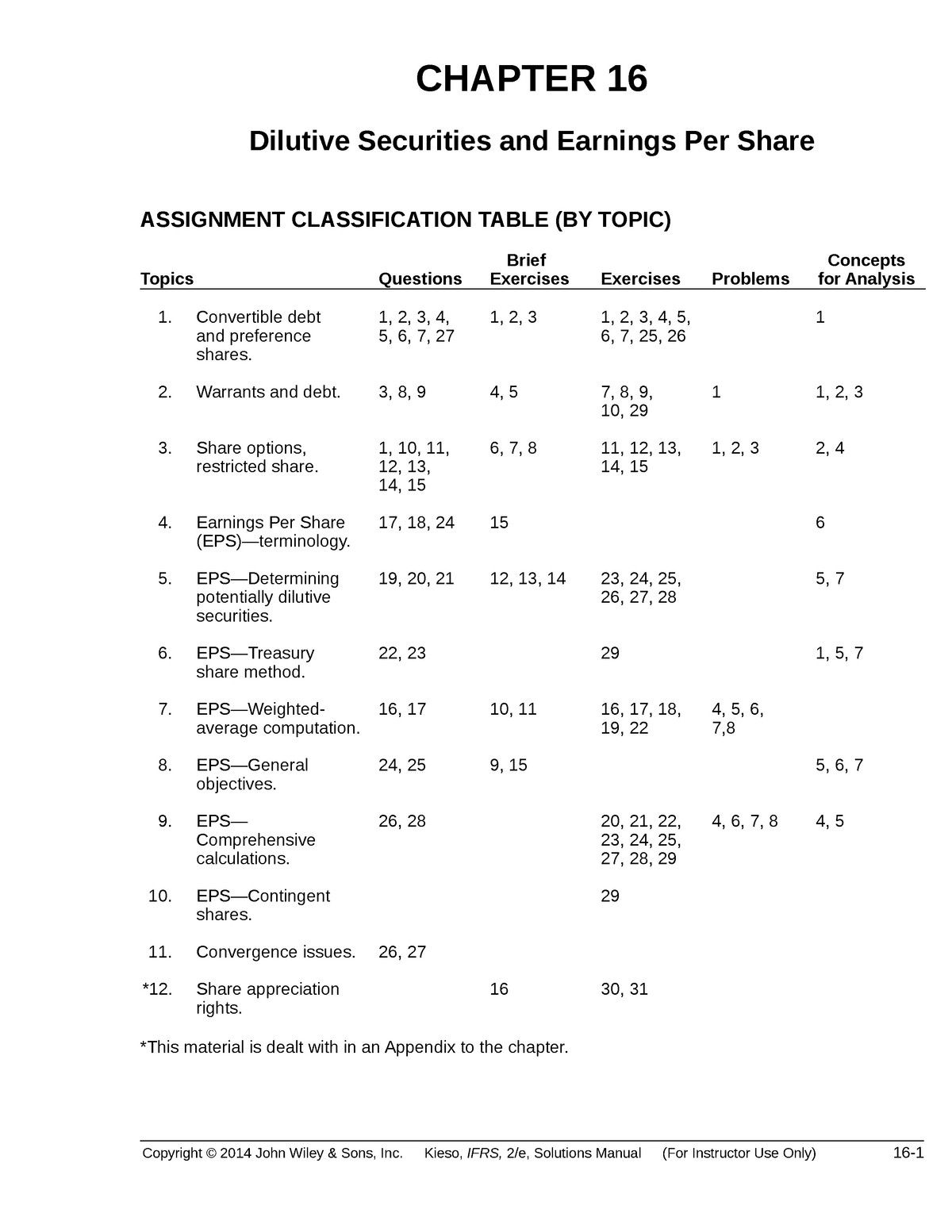

Dilutive securities are any financial instruments that can potentially increase the number of shares outstanding. This means that such an instrument can be converted into a share of common stock. The concept is of importance when calculating fully diluted earnings per share, where the effect of these securities can reduce earnings per share. A reduced amount of earnings per share could drive away investors, thereby lowering the price of a company’s stock. The if-converted method is used to calculate diluted EPS if a company has potentially dilutive preferred stock. To use it, subtract preferred dividend payments from net income in the numerator and add the number of new common shares that would be issued if converted to the weighted average number of shares outstanding in the denominator.

- Stock options are often used as a form of employee compensation, and they can be exercised at a later date.

- The most common types of securities include stock options, warrants, convertible preferred stocks, convertible bonds, and anti-dilution provisions.

- Anti-dilutive securities do not affect shareholder value and are not factored into the diluted EPS calculation.

- In this case, there is no change in the numerator and an increase in the denominator, resulting in reduction in EPS.

What Is an Anti-Dilution Provision?

Diluted shares are most commonly used to calculate a company’s earnings per share (EPS). For a financial analyst, it is important to have a solid understanding of the difference between basic and fully diluted shares and what it means for key metrics including EPS. Fully diluted EPS is calculated by subtracting preferred dividends from net income and then dividing the result by the sum of outstanding shares and potential dilutive securities. The formula for fully diluted EPS is (Net income – Preferred dividends) / (Outstanding shares + Conversion of dilutive securities). The EPS calculation takes into account the company’s net income and the number of outstanding shares. The fully diluted EPS calculation goes a step further and considers the impact of all potentially dilutive securities on the number of outstanding shares.

Dilutive Securities and Anti-dilutive Securities

It is relatively simple to analyze diluted EPS as it is presented in financial statements. Companies report key line items that can be used to analyze the effects of dilution. These line items are basic EPS, diluted EPS, weighted average shares outstanding, and diluted weighted average shares. Many companies also report basic EPS excluding extraordinary items, basic EPS including extraordinary items, dilution adjustment, diluted EPS excluding extraordinary items, and diluted EPS including extraordinary items.

How Does a Diluted EPS Affect Shareholders?

Despite the fact that the fully diluted EPS is larger than the primary EPS, both results must be disclosed. In this article, three aspects of anti-dilution are discussed in more detail. In this case, there is no change in the numerator and an increase in the denominator, resulting in reduction in EPS. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Opposite Effects on EPS Before and After Extraordinary Items

These are common with convertible preferred stock, which is a favored form of venture capital investment. Fully diluted EPS is a financial metric used to assess a company’s profitability and earnings per share. It takes into account all potential dilutive securities that could convert into common stock and affect the number of outstanding shares. Convertible bonds are a type of bond that can be converted into common stock at a later date. When convertible bonds are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. Diluted EPS is considered a conservative metric because it indicates reduced earnings per share (EPS) when all convertible securities are exercised.

There are now 20 total shares outstanding and the new investor owns 50% of the company. Meanwhile, each original investor now owns just 5% of the company—one share out of 20 outstanding—because their ownership has been diluted by the new shares. If the company then has a secondary offering and issues 100 new shares to 100 more shareholders, each shareholder only owns 0.5% of the company. The smaller ownership percentage also diminishes each investor’s voting power.

Total shares outstanding may increase because of new share issuance based on a round of equity financing. Dilution can also occur when holders of stock options, such as company employees, or holders essential bookkeeping tips for your photography business of other optionable securities exercise their options. When exercised, certain derivatives instruments are exchanged for shares of stock that are issued by the company to its employees.

Diluted EPS measures a company’s earnings per share if all convertible securities are exercised at once. It isn’t just shareholders who are concerned about dilution of EPS through the exercising of securities. Both accountants and financial analysts compute diluted earnings per share as a worst-case scenario when evaluating a company’s stock. If stock equivalents are potentially dilutive, they are added together to form the stock equivalent units (seu). These seus are then included in the calculation of eps until it is reduced to the smallest possible number.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. By understanding the fully diluted EPS calculation and its limitations, investors can make more informed investment decisions. For investment guidance, consider speaking to a wealth management professional.

Diluted eps takes into account all stock equivalents outstanding during a reporting period. To determine if this point is maximum dilution, alternate calculations can be made. These calculations involve bringing in the savings and new shares in order from the most to the least dilutive. That is to say, the fully diluted loss per share would be smaller than the primary loss per share, and this result would not be consistent with the worst-case assumption.